Selling a Business: Valuing Future Earnings

29 November 2021: Selling a Business/Valuing Future Earnings

Last week’s post about using an earn-out when selling a business raised an important question. “How do we estimate the value of a business’ future earnings?”

Well, before we can answer that question, we have to ask, “How can we determine the future earnings?”

Because this is the more basic of the two questions, let’s tackle that one first.

Future Earnings

Determining a business’ future earnings is as much an art as a science and we need to know that whatever numbers we arrive at will be wrong. I mean, it’s impossible to determine what anything other than a marble statue will look like in the future. And in the U.S., even marble statues have been under increasing attack over the past year or two!

Determining a business’ future earnings is as much an art as a science and we need to know that whatever numbers we arrive at will be wrong. I mean, it’s impossible to determine what anything other than a marble statue will look like in the future. And in the U.S., even marble statues have been under increasing attack over the past year or two!

So, if we can’t be precise – and we can’t – we’re going to have to estimate. And we have to remember that the buyer and the seller will arrive at different estimates – neither of which will be correct but, hopefully, not so far apart as the parties won’t be able to agree on an estimate.

We have to start by estimating future revenue based on projections that we hope are reasonably realistic.

Revisiting the examples used in last week’s post, in the case of a newly-signed Walmart agreement, this should be fairly simple. Walmart projects some sell-through numbers from which the business owner should be able to estimate revenue. This should be basic math that a buyer shouldn’t find much fault with.

In the case of a convenience store that just happens to be across the street from a just-approved 400-unit apartment project, estimating future revenue is a bit more complex but, as explained in our Course, not overly difficult for anyone with a modest grasp of math and basic research skills. This is not something that requires the analytical skills and intuitive talents of Sherlock Holmes!

_____________________________________________________________________________

Our course, “Learn How to Value and SUCCESSFULLY Sell Businesses“, teaches you how to value and sell businesses.

Become a Professional Business Broker…

Once an estimate of revenue is arrived at, estimating expenses is next. This involves analyzing the business’ expenses – both actual numbers and as a percentage of revenue – over the previous couple of years. We developed a spread sheet that spits out some very useful results based upon our analysis and the seller’s estimation of future need. This is where some serious analysis comes into play.

What will change? Will occupancy costs (rent, utilities, etc.) increase? Will payroll increase? How will this additional revenue impact the cost of goods as a percentage of revenue?

What will change? Will occupancy costs (rent, utilities, etc.) increase? Will payroll increase? How will this additional revenue impact the cost of goods as a percentage of revenue?

Some expenses may remain constant. Examples might be rent and certain utility costs such as phones. Others may remain constant as a percentage of revenue. For example, insurance or taxes. But still others might change significantly.

For example, will the business need to add staff or equipment? Will that new Walmart order require three additional bodies to produce and package the goods as well as two new drivers to deliver the finished product? Will those two new drivers require two additional trucks the operation of which will increase fuel, maintenance and insurance costs?

Again, this is an art as much as a science. It’s impossible to predict the future with any precision but we have to try to be realistic in our estimate because, if the buyer is going to be paying for the future earnings, the buyer is going to run its own calculations. We have to have “defensible” numbers.

Once the revenue and expenses are determined, we usually perform a “thumbnail” recasting to make sure we end up with a realistic estimate of “Discretionary Earnings”, not taxable income. We repeat this process of projecting the estimated earnings for the next three to five years.

Now for a quick note on timelines: going out five years is dicey enough. Estimating numbers for anything beyond that is pure fiction; don’t waste your time.

We’ve launched a coaching program specifically tailored to Realtors that want to sell businesses, business owners and to anyone that wants to become a business broker.

If you’d like to learn more, email me at jo*@Wo*******************.com

So, assuming a serious analysis has been done and conclusions that can be defended to a buyer have been arrived at, we now have several years of estimated earnings. And now’s the time to ask the second question: what are those future earnings worth today, in current dollars? To answer that question, we have to perform a discounted cash flow analysis (DCF).

What is a Discounted Cash Flow Analysis?

A discounted cash flow analysis (DCFA) is a valuation method used to estimate the Net Present Value – the current value of future earnings – of an investment based on those expected future earnings. A DCFA attempts to figure out the value, in today’s dollars, of the money an investment will generate in the future. This applies to the decisions of investors in companies or securities, such as acquiring a company or buying a stock.

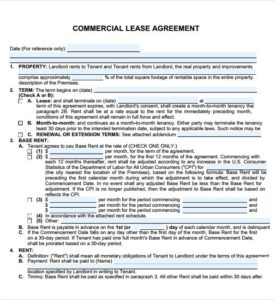

When selling a business, a Discounted Cash Flow Analysis is generally used when the business has a relatively lengthy history of revenue and earnings and when a substantial portion of its revenue and net income are derived from existing contracts. To give a clear illustration, it is most often used in the valuation and appraisal processes for commercial real estate where leases exist and net future income can be projected with some degree of accuracy.

When selling a business, a Discounted Cash Flow Analysis is generally used when the business has a relatively lengthy history of revenue and earnings and when a substantial portion of its revenue and net income are derived from existing contracts. To give a clear illustration, it is most often used in the valuation and appraisal processes for commercial real estate where leases exist and net future income can be projected with some degree of accuracy.

In business valuations, it is useful when the subject business’ future earnings are likely to be significantly increased as the result of a recent event the impact of which will not be felt immediately. Examples include the Walmart contract and 400-unit apartment project across the street from the convenience store mentioned earlier.

Though a DCFA can be and often is used when valuing a business with recurring revenue from existing contracts, it is extremely useful when a seller wants to be paid for earnings that have not yet materialized – as in an earn-out. In determining the value of future cash flows in a business, one considers whether such future cash flows will result from efforts expended by the current owner (i.e., the Walmart contract) or even from a market development completely unrelated to whether the owner ever got out of bed for the past six months (i.e., the 400-unit apartment project).

The DCFA Challenge

Using a DCFA requires establishing a “discount rate” that is applied to the expected future cash flows. And this is where things get dicey.

Establishing such discount rate involves considering multiple factors among which are the current business environment, the risk inherent in small business ownership and, employing the Principle of Substitution, the returns possible in alternative, safe investments available to the buyer.

The discount rate to be applied to a given business can vary widely. Considering the risk, burden of management, lack of liquidity, etc. involved in the investment in an owner-operated small business, establishing a market-derived discount rate in a recent example in our office resulted in an initial range of 22% to a high of 44.5%.

The discount rate to be applied to a given business can vary widely. Considering the risk, burden of management, lack of liquidity, etc. involved in the investment in an owner-operated small business, establishing a market-derived discount rate in a recent example in our office resulted in an initial range of 22% to a high of 44.5%.

Using the time-honored rule that valuing a business is as much art as it is science, the broker performing this particular valuation – a Certified Business Intermediary (CBI) with more than a dozen years of experience – settled on 36.2%.

That rate was then applied to the earnings estimated by the earlier analysis – in this case the earnings estimated for each of the next five years. The results of those five calculations are then added and the resulting total is the best estimate of the total value of the next five years’ earnings.

The seller’s earn-out provision when selling a business can be structured in several ways based on that value; quarterly or annual targets are common but using total accumulated earnings is not unheard of.

The Bottom Line

When selling a business, the DCFA has limitations, primarily in that it relies on estimations of future cash flows, which could – and probably will – prove to be inaccurate. In addition, whatever discount rate is established to try to estimate the Net Present Value of those earnings is arbitrary and based on the broker’s experience and knowledge.

But if reasonable parties are negotiating on both sides, an acceptable rate should be able to be agreed on. And, once that’s done, that rate can be applied to the actual numbers in the years covering the earn-out, assuring that the seller is getting the value of his or her work and the buyer isn’t overpaying for the business.

If you have any questions or comments on this topic – or any topic related to business – I’d like to hear from you. Put them in the comments box below. Start the conversation and I’ll get back to you with answers or my own comments. If I get enough on one topic, I’ll address them in a future post or podcast.

Searching For…

This week’s “Searching For” item comes from an individual buyer in the U.S. looking for an opportunity in B2B services and B2B software and technology. Specifically a business in those verticals with revenue of anywhere between $3 million and $30 million.

If any of you know of something that might fit, please let me know.

I’ll be back with you again next Monday. In the meantime, I hope you have a safe and profitable week.

Joe

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagents

#business #businessacquisition #sellabusiness #becomeabusinessbroker #businessbrokering #businessvaluation #MergersandAcquisitions #buyabusiness #sellabusiness #realtor #realestateagentsThe author is the founder of Worldwide Business Brokers and holds a certification from the International Business Brokers Association (IBBA) as a Certified Business Intermediary (CBI) of which there are fewer than 1,000 in the world. He can be reached at jo*@Wo*******************.com